indiana inheritance tax exemptions

For individuals dying after December 31 2012. Though Indiana does not have an estate tax you still may have to pay the federal estate tax if you have enough assets.

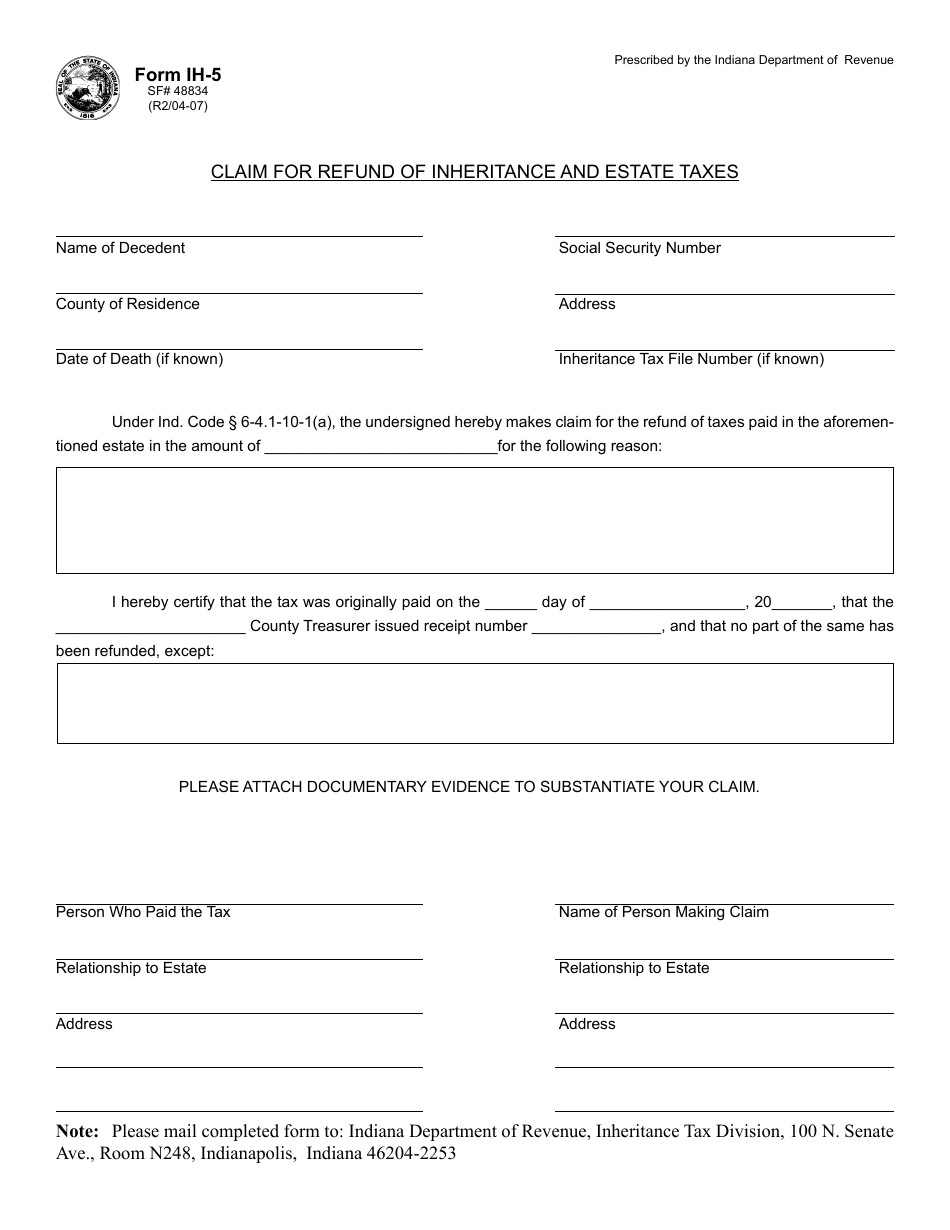

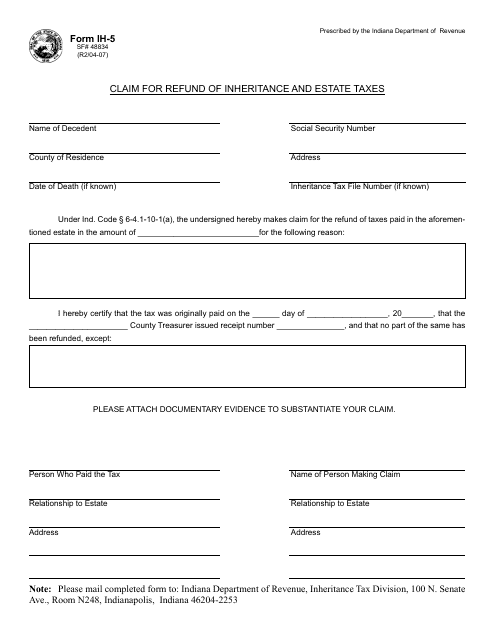

Form Ih 5 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Business or occupation 3.

. Ie the total value of interest minus the applicable exemption by the appropriate tax rate. Of Revenue Inheritance Tax Division 317 232-2154. Each class is entitled to a specific exemption IC6-41-3-91.

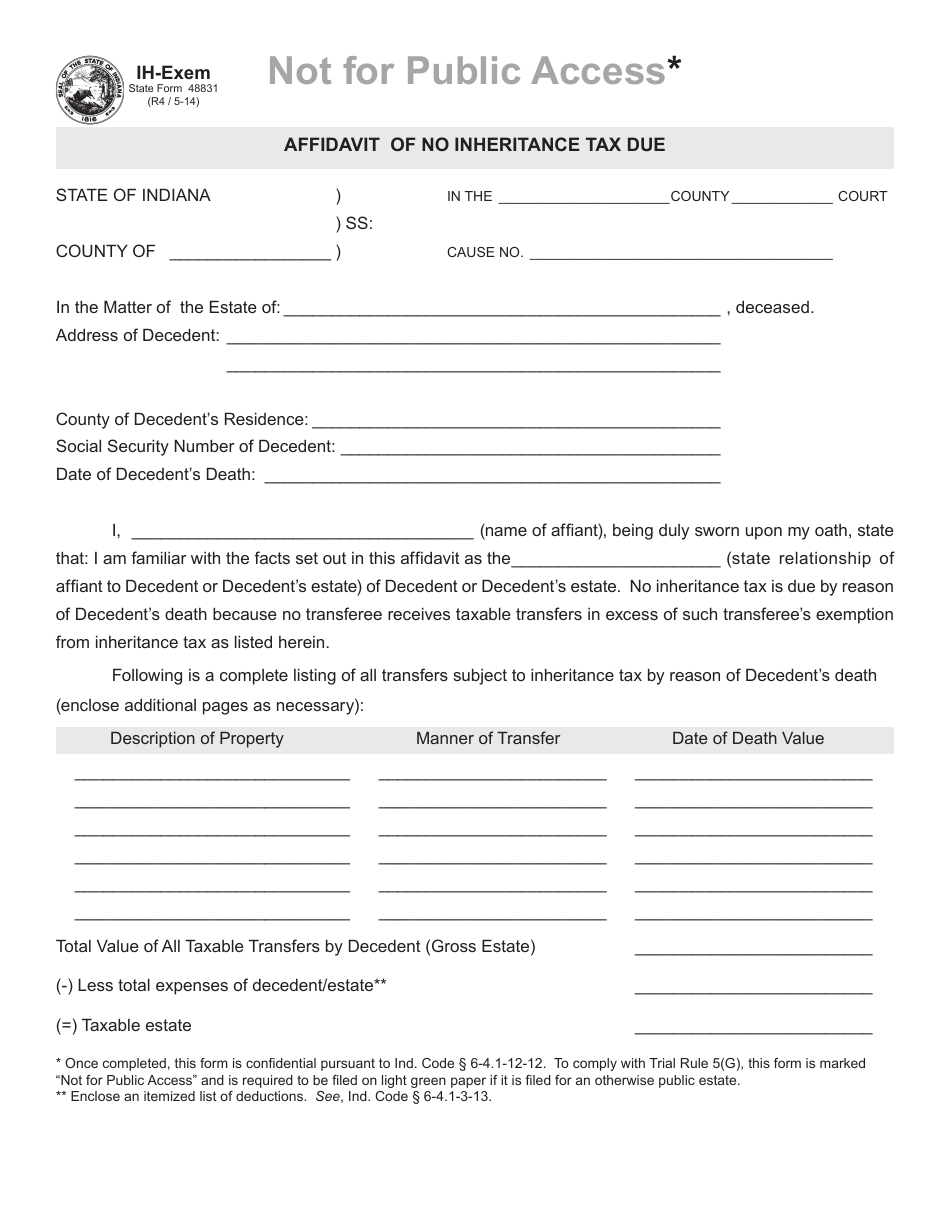

The other 250000 inherited by each child would incur a tax of 7250. Indiana does not have an inheritance tax nor does it have a gift tax. If real estate is included in the property subject to taxable transfers by Decedent the affidavit may be recorded in the office of the county recorder.

This item is available to borrow from 1 library branch. The first one hundred dollars 100 of property interests transferred to a Class C transferee under a taxable transfer or transfers is exempt from the inheritance tax. While the Inheritance Tax rates for the assets passing to children and grandchildren because of the existing 250000 exemption generally resulted in tax rates that were approximately equivalent to sales tax.

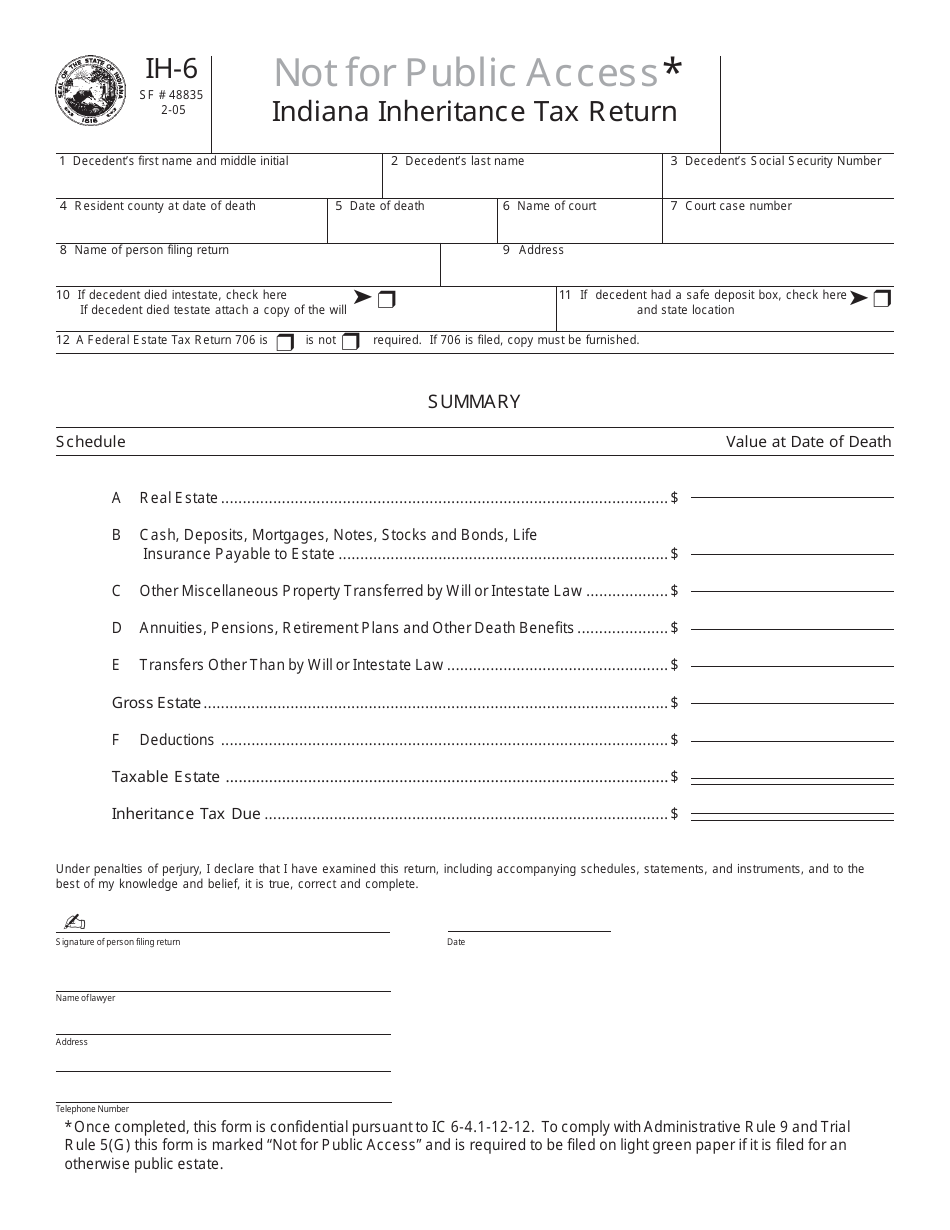

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. A 2012 Indiana law began a slow phase-out of the Indiana Inheritance Tax that applied a credit increasing year by year to the total Indiana Inheritance Tax and was repealed for the estates of decedents dying on.

Anyone who doesnt fit into Class A or B goes hereincluding for example aunts uncles cousins friends nieces and nephews by marriage and corporations. The first inheritance tax law of indiana was passed in 1913. 2012 legislative changes to inheritance tax.

The item Inheritance tax. Repeal of Inheritance Tax PL. Exemption Levels for Beneficiaries and Heirs Prior to 2012 100 Exempt Surviving spouse charitable organizations Class A 100000.

The inheritance tax rates are Class A Net Taxable Value Of Property Interests Transferred Inheritance Tax 25000 or less 1 of net taxable value Over 25000 but not over 50000 250 plus 2 of net taxable value over 25000 Over 50000 but not over 200000. Date of death 4. 205 2013 Indianas inheritance tax was repealed.

Miscellaneous taxes and exemptions represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library. On the other hand indianas changes to the inheritance tax allow for more family members to receive larger exemptions while slowly phasing out inheritance tax entirely. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account Form IH-19 are required for those dying after Dec.

However be sure you remember to file the following. If a financial institution has a 20 hold placed on an account for an extended period of time contact the Indiana Dept. Please read carefully the general instructions before preparing this return.

In 2013 there would be a 10 credit against this tax which is 725 and thus the actual tax. They do not owe inheritance tax unless they inherit more than 500. Does Indiana Have an Inheritance Tax or Estate Tax.

The amounts paid could still be significant. The available exemptions and the tax rates usually vary based on how closely each transferee is related if at all to the decedent. Each heir or beneficiary of a decedents estate is divided into three classes.

However many states realize that citizens can avoid these taxes by simply moving to another state. The federal government does not impose an inheritance tax so the recent tax changes from the Trump administration did not affect the inheritance taxes imposed by the states. Decedents residence domicile at time of death 5.

The IRS did however change the federal estate tax exemption from 2018 to 2019 from 1118 million to 114 million. Also effective as of January 1 2012 the Class A transferee exemption for lineal descendants and lineal ancestors such as children grandchildren stepchildren parents and grandparents increases from 100000 to 250000 per person. The first 250000 for each child would be exempt.

In addition no Consents to Transfer Form IH-. Spouse Children Grandchildren Parents Effective July 1 1997 the first 10000000 of an estate going. States have typically thought of these taxes as a way to increase their revenues.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed and no tax has to be paid. As added by Acts 1976 PL18 SEC1. IC 6-41-3-125 Repealed Repealed by PL252-2001 SEC38 IC 6-41-3-13.

No tax has to be paid. Final individual federal and state income tax returns each due by tax day of the year following the individuals death. Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7.

The good news is that every taxpayer is entitled to make use of the lifetime exemption to reduce the amount of gift and estate taxes owed by their estate. Code 6-41-3-10 through 6-41-3-12 for specific exemption amounts. Social Security number 6.

Indiana tax exemptions relating to specific events held in indiana and. Indiana Inheritance Tax Exemptions and Rates. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note.

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. The amount of each beneficiarys exemption is. The exemption for the federal estate tax is 1170 million in 2021 and increases to 1206 million in 2022.

ATRA set the lifetime exemption amount at 5 million to be adjusted for inflation each year. Allowable exemptions are unlimited for Decedents surviving spouse and for qualified charitable entities. There is also an unlimited charitable deduction for inheritance tax purposes.

The decedents surviving spouse pays no inheritance tax due to an unlimited marital deduction. Each inherits 500000.

State Form 48831 Ih Exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Calculating Inheritance Tax Laws Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

Fillable Online Ih 6 Not For Public Access Indiana Inheritance Tax Return Fax Email Print Pdffiller

Indiana Estate Tax Everything You Need To Know Smartasset

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes

Form Ih 5 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

How Do State Estate And Inheritance Taxes Work Tax Policy Center